As Trump Talks Privatization, Is Freddie Mac Stock a Buy, Sell, or Hold?

Freddie Mac (FMCC) and Fannie Mae (FNMA) shares surged to their highest levels since 2008 following President Donald Trump’s comments that he is giving “very serious consideration” to privatizing the government-sponsored enterprises (GSEs). FMCC stock jumped 42% on May 22, while FNMA stock rose 51%.

The U.S. Treasury currently owns preferred shares and warrants for approximately 80% of both GSEs’ common stock, stemming from the bailout of these companies during the 2008 financial crisis. Trump indicated that he would consult with Treasury Secretary Scott Bessent and other officials before making a final decision.

A potential privatization could generate over $250 billion for the government and benefit major shareholders, such as Bill Ackman’s Pershing Square, which holds approximately 10% of Fannie Mae and Freddie Mac.

Both companies have recovered strongly since the crisis, returning to profitability in 2012 and having since fully repayed their government loans.

How Did FMCC Stock Perform in Q1 2025?

Freddie Mac delivered solid first-quarter results with net income of $2.8 billion, driving net worth to $62 billion as the government-sponsored enterprise benefits from regulatory changes under new Federal Housing Finance Agency leadership.

The mortgage giant reported a 1% increase in net income year-over-year, supported by 7% growth in net interest income, which increased to $5.1 billion. This growth was tied to mortgage portfolio expansion and lower funding costs, partially offset by reduced yields on short-term investments. However, noninterest income declined 25% to $750 million, due to decreased investment gains in the multifamily segment.

Freddie Mac facilitated homeownership for 313,000 families during the quarter, with 52% of single-family loan purchases supporting first-time homebuyers. The company’s single-family segment drove performance, with net income of $2.3 billion, a 16% year-over-year increase. New business activity totaled $78 billion, compared to $62 billion in the prior year.

The multifamily segment faced headwinds, with net income declining 35% to $533 million, due to lower noninterest income and less favorable fair value adjustments. Despite challenges, the segment financed 89,000 rental units, with 66% affordable to low-income families.

Credit quality metrics remained stable, with single-family serious delinquency rates at 59 basis points. However, multifamily delinquencies increased to 46 basis points, primarily due to floating-rate loans.

CFO Jim Whitlinger highlighted regulatory streamlining under Director Bill Pulte, including the elimination of non-essential activities and bureaucracy reduction. These changes are expected to lower general and administrative expenses while enabling increased loan acquisitions and technology investments, ultimately reducing mortgage origination costs for borrowers.

Of the two analysts covering FMCC stock, one recommends a “Moderate Sell” and the other recommends a “Strong Sell.” The average target price of FMCC stock is $3.25, below the current trading price near $8.

How Did FNMA Stock Perform in Q1 2025?

Fannie Mae also delivered solid Q1 results, with net income of $3.7 billion, marking its 29th consecutive quarter of profitability.

The mortgage giant reported net revenue of $7.1 billion, flat year-over-year, driven by guaranteed fee income from its $4.1 trillion book of business. Net worth grew to $98 billion, representing nearly 20% growth from the prior-year quarter, while the company has accumulated $41 billion in regulatory capital since late 2022.

Despite challenging market conditions, Fannie Mae provided $76 billion in liquidity during the quarter, supporting 287,000 households through home purchases, refinancing, and rental housing.

It acquired $64 billion in single-family loans, up 3% year-over-year, with first-time homebuyers representing half of purchase loan acquisitions, totaling 74,000 transactions. Multifamily acquisitions increased to $11.8 billion from $10.1 billion previously.

Housing market conditions remained difficult with 30-year mortgage rates averaging 6.8% during the quarter, while home prices increased 5.2% year-over-year. Total home sales rose slightly to 4.8 million units but remained well below pre-pandemic levels due to affordability constraints and inventory shortages.

Credit quality metrics remained strong, with single-family serious delinquency rates at 56 basis points and a weighted average loan-to-value ratio of 50%. Multifamily delinquencies increased to 63 basis points but remain well-protected through risk-sharing programs.

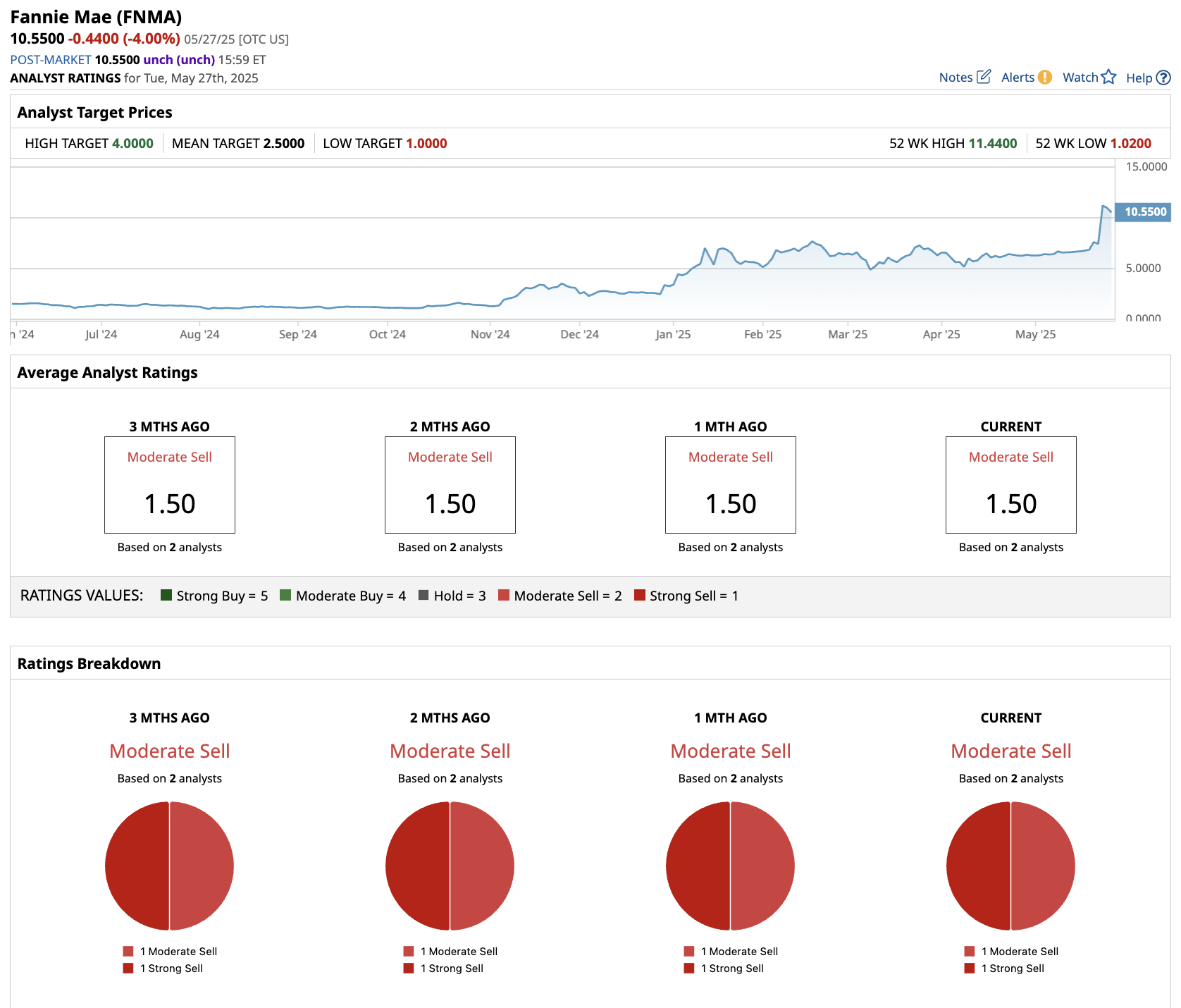

Of the two analysts covering FNMA stock, one recommends “Moderate Sell” and one recommends “Strong Sell.” The average target price of FMCC stock is $2.50, which is below the current trading price near $11.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.